When Tully Williams, parts and service director at the Niello Company, looked at his used-car recon numbers earlier this year, he saw the problem immediately: cars were sitting too long between acquisition and the front line.

“It started four to five days. Now we’re two days,” Williams explained to Daily Dealer Live hosts Sam D'Arc and Uli de’ Martino.

For Williams, that metric isn’t about money—it’s about capacity.

“We sold 138% of our hours forecast. I don’t care about the money. I care about selling our capacity,” he explained.

Here’s how: He made recon a fixed-ops priority.

“We focus on two things,” he said. “When we buy the car, how many days until it gets to the shop? And then how many days in the shop? If that’s over two days, we have a serious problem.”

The solution: A dedicated internal advisor and technician team whose pay plans are based not on gross profit, but on days in shop.

He also empowered each store to use whatever tool worked best—from Xtime to Rapid Recon—as long as they hit the number.

“If you’re at three, you’re in the negative. We really want two days in the shop,” he said.

Why it works: Dedicated teams keep focus tight and eliminate the tug-of-war between service and sales.

“If you let your service advisors or your overall technicians work on it, all used cars get pushed off,” Williams said. “If you have a dedicated internal advisor paid on days in shop, not gross, cars get done.”

He also tied used-car manager pay to recon gross to align departments.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

Get insights trusted by 55,000+ car dealers. Free, fast, and built for automotive leaders.

“All my used-car managers get paid on recon gross,” he said. “It takes the tension away, and that helped us a lot.”

That collaboration turned a soft month into a win.

“Warranty and customer pay were down, but used cars came through. We gave a tremendous amount of quality, great recon vehicles to the used-car department to sell,” he added.

The impact: Williams says every recon ticket is an opportunity for customer retention.

“Every recon ticket is what—a new customer for us,” he said. “We’re in the repeat-referral business.”

And quality control is strict.

“Comebacks—zero tolerance,” Williams said. “We have pictures and video and a digital inspection on every car, as we would a customer’s car.”

Bottom line: Williams believes fixed ops is the backbone of the dealership—and recon speed is now a measurable profit driver.

“Sales only sells the first car,” he said. “If it wasn’t for fixed ops, sales couldn’t sell the second, third, fourth, or 50th car.”

By aligning incentives, tracking every hour, and obsessing over speed and quality, the Niello Company turned recon from a bottleneck into a growth engine—and, in Williams’ words, “the reason we’re in business.”

A quick word from our partner

Want insider knowledge on the most up-to-date trends in auto retail?

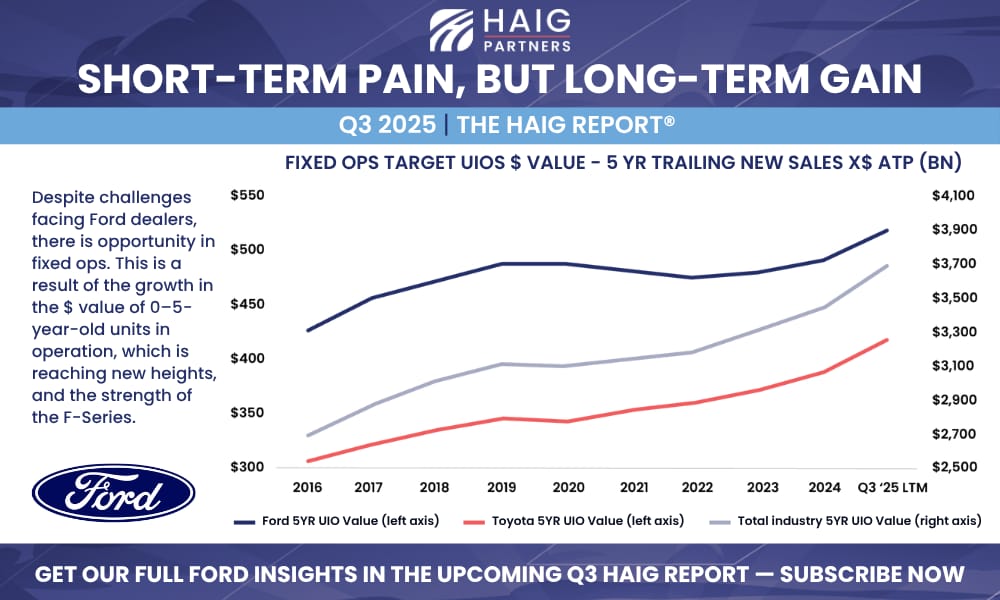

Here’s a sneak peek of what’s coming in the Q3 2025 Haig Report®—auto retail’s longest-published and most trusted quarterly report tracking trends and their impact on dealership values. Since 2014, the Haig Report® has delivered expert analysis on dealership performance, market activity, and franchise valuations, offering a clear view of opportunities and challenges in automotive retail.

Learn more in the full Q3 2025 Haig Report® by subscribing to receive it as soon as it’s released.