Presented by:

Hey everyone,

Throwing our second annual party in Las Vegas during NADA 2026!

Will be attended by top dealers, industry leaders and several special guests.

Space is very limited but opening up a waitlist below:

Big shoutout to Impel and CallRevu for their support of the event!

Can't wait.

First time reading the CDG Newsletter?

Welcome to The Breakdown, an analysis of auto retail’s top trends, moves, and insights—in under 5 minutes.

Auto lending rarely follows a straight line, and 2025 is no exception.

After the Federal Reserve delivered three rate cuts starting last September, many economists expected that relief to continue ramping up, and flow further down to the car market.

But inflation is proving sticky, and some analysts are walking back their forecasts.

However, as more car buyers shop with higher debt loads, thinner credit files, and less flexibility on monthly payments—lenders are adjusting behind the scenes.

Which, inevitably, sets the guardrails for everything else. Here are three auto financing trends dealers must know to understand where credit conditions might be heading…

Used car loan-to-value ratios are reaching new peaks.

The average loan-to-value ratio (LTV) for used car originations is creeping up steadily across all lender types, including banks, captive financiers, credit unions, and independent lenders, according to TransUnion.

In Q2 2022, just 38% of used vehicle loans carried LTV ratios above 120%, meaning buyers owed nearly 20% more than the car's worth at origination (not that uncommon). But by Q2 2025, this number jumped to 53%.

And used car loans with LTVs 140%+ nearly doubled from 17% to 31% over the same period.

Via TransUnion

The problem: LTVs signal how much risk lenders and dealers are taking on. And when they soar, it leads to tougher loan approvals, tighter lender underwriting, and greater chance of losses if things go wrong.

Combined with the fact that seven-year auto loans now make up 21% of the market (edging out five-year terms at 18% per Edmunds) and you have the perfect recipe for a feedback loop where consumers roll over their remaining balances into new financing, and continue inflating loan amounts.

The fix: Many dealers are leaning heavily into new leases that have inherently lower LTV exposure and more flexible terms. By steering consumers to lease specials, dealers can often help consumers manage any rolling debt, keep monthly payments on the lower side, and move a new unit.

A quick word from our partner

Winning in today’s market means more than just adjusting prices or boosting ad spend.

It’s about seeing what’s holding each vehicle back - and taking smarter action from day one.

Long before AI became a buzzword, Lotlinx built the industry's first VIN performance platform — powered by AI and the most robust dataset of VIN and shopper behavior — to help dealers optimize every vehicle and maximize profit.

With Lotlinx, dealers can:

Spot inventory risk before it hits

Move cars with precision

Turn each VIN Into a star

Visit lotlinx.com to discover how to win with every VIN and maximize profit - one VIN at a time.

American’s are getting steamrolled by “underwater” car loans.

Also known as negative equity, the amount of customers who traded in a vehicle that was worth less than the remaining balance of their loan, reached 26.6%—a four-year high, reported Edmunds.

Via Edmunds

These customers now owe $6,754 on average, and it’s causing some major financial consequences.

The average monthly payment for buyers who rolled negative equity into a new loan climbed to $915 in Q2—the highest on record and $159 more than the industry average.

They also financed $12,145 more than the typical new car buyer.

The problem: With cars costing more and auto loan rates still elevated, the financial hit from trading in too soon or carrying old debt forward is harder for buyers to absorb. And it leaves these customers exposed to delinquencies, defaults, and repossessions.

And as more borrowers stay locked into underwater loans, they're less motivated to trade up or replace their current vehicle, meaning fewer used cars enter the market. Of course, this tightens supply and keeps prices high.

The fix: Dealers are acquiring used inventory with high and stable resale values (usually through the service drive) to shield buyers from negative equity risk. Models like Toyota trucks and Honda midsize SUVs are being used as anchors for used vehicle programs, alongside cash incentives to help customers “dig their way out.”

Auto loan refinancing is spiking, and not all borrowers are benefiting equally.

According to Experian's Q2 2025 State of the Auto Finance Market report, auto loan refinancing surged 69% last quarter compared to last year as auto loan rates steadily creep down.

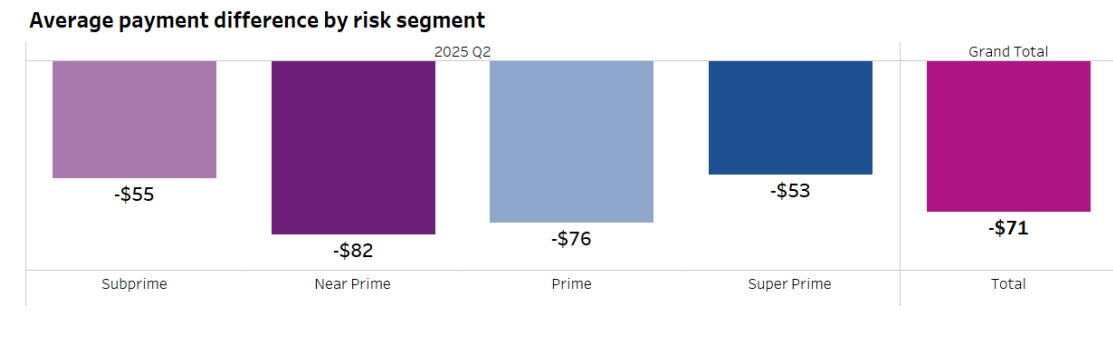

Consumers who refinanced their car loans dropped their average rate from 10.45% to 8.45%—a full two percentage points lower, translating to roughly $71 less per month.

A year ago, auto loan refinancers only saved 0.93% on their rates, with average rates dropping from 10.54% to 9.60%.

This is great news for consumers. Well… most of them.

Subprime borrowers are often too “risky” to qualify for refinancing.

Prime borrowers make up 52% of refinancing volume despite representing only 35% of outstanding auto loan balances.

And although subprime borrowers only represent 19% of outstanding balances—they make up a measly 12% of the overall pool.

The downside for dealers: Another refi surge this fall could drain late-model trades that drive profit and fuel certified pre-owned (CPO) supply.

The fix: Dealership leaders like Matt Lasher from West Herr Auto Group are taking matters into their own hands.

"During COVID, we didn't have deal structure problems—artificially low interest rates, artificially high book values," he told me. "But now deal structure is of increasing importance."

Matt Lasher

So, Matt started building an in-house fintech platform that was initially a vehicle selection tool and budget calculator to help salespeople guide customers.

The data-heavy solution (which sits inside the auto group’s RouteOne and Dealertrack toolkits) now assesses factors like higher interest rates, higher bank fees, and other affordability variables before approval problems surface.

“Any of us who's been a manager at a retail store has been presented a deal by a salesperson that's probably not a deal. The [loan-to-value ratio] LTV is 180% or maybe we forgot to include the negative equity of the trade. It happens,” he said.

At the end of the day, auto credit access is always going to ebb and flow.

But what’s different in 2025 is how quickly those shifts ripple through the dealership. The stores that win won’t just react to what lenders are doing. Instead, they’ll bake lending awareness into every decision, from the cars they buy to the deals they pencil.

What are you seeing on the ground-level at your dealership? Hit Reply to this email and let me know.

Missed yesterday’s episode of Daily Dealer Live?

Presented by:

Miller on EV profitability, Toma on AI-hesitancy, Growden on dealer waste

Featured guests:

Eric Miller, Director at Morrie’s Auto Group

Monik Pamecha, CEO of Toma

Mathew Growden, Industry consultant

This week on the

Against all odds: This dealer's rise from refugee to 29-store auto empire

Stream now on:

"Money's not in the CRM, it's in the DMS!”—tracking the pulse of AI in dealerships

Stream now on: