- Car Dealership Guy News

- Posts

- Are chip shortages over, Where are used car prices are heading?

Are chip shortages over, Where are used car prices are heading?

Plus, Scott Painter on Subscribing vs. Owning, Future of mobility, EV predictions, and more.

Today’s topics:

⚡️ Are chip shortages over?

📉 What’s next for used car prices?

🎙️ My conversation with Scott Painter, Founder & CEO of Autonomy: Subscribing vs. Owning, Future of mobility, EV predictions, and more…

Reading time: ~2.5 min

⚡️ Are chip shortages over?

Good news to report! Chip shortages are tapering off according to various sources. S & P estimates that over the past couple of years, 9.5 million cars were not produced globally due to the chip supply disruptions. Fast forward to today, the “underproduction” of new vehicles in the first half of 2023 only amounted to about ~500K units.

By now most auto makers have adapted to the new normal: they’ve developed additional chip suppliers and invested in new plants to diversify their locations so they can access those parts when needed.

At the same time, chip manufacturers were able to shift some of their production capacity from telecom and consumer electronics to automotive-specific applications.

Another trend worth noting is the consolidation of disparate components into more specialized systems-on-chips. This reduces the number of parts per vehicle, at the expense of building more powerful and complex components.

This is a good thing because the industry demand for complex electronics is increasing. S&P Global Mobility analyst estimates that the value of semiconductors installed in vehicles averaged $500 per car in 2020, but is forecasted to triple that amount by 2028.

Source: S&P Mobility

Dealerships are still feeling some repercussions of years of chip shortages in new and used markets. Facing tight supply of key parts, auto manufacturers allocated precious chips to more profitable - and more expensive - vehicles.

At the same time, a report from Edmunds shows that the average monthly payments also reached a new record high of $733 in Q2, which is way above the affordability threshold of $400.

Moreover, the share of consumers who financed a vehicle with a monthly payment of $1,000 or more reached a new all-time peak of 17.1% in Q2. The majority of consumers making these crazy payments are also signing up for terms between 67 and 84 months. In addition to paying insane amounts of interest over the lifetime of the loan, they risk being upside down on their equity.

Under-discussed but auto loan rates on New cars are *still* rising.

We set a new multi-decade record high in July:

9.17% APR.

If you take out a $50K auto loan today (vs 18 mths ago), you’ll be on the hook for ~$7K more in interest expense over the life of a 5-year loan… Wild.

— CarDealershipGuy (@GuyDealership)

8:58 PM • Jul 19, 2023

Unable to find affordable new cars, shoppers switch to certified pre-owned ones (CPO) fueling the growth in CPO sales by 8.4% in June over the previous year, as reported by Cox. Lenders offer better rates on CPO units, making them a more affordable option to new cars.

Consumers are facing another obstacle: the rising cost of auto insurance, with premiums jumping 6.8% year-over-year.

Why are premiums rising? Look no further than higher sticker prices as the main driver behind this increase. Other factors in play are increasing miles driven, increasing labor costs to repair vehicles, increasing catalytic converter thefts, and increasing complexity of vehicles.

📉 What’s next for used car prices?

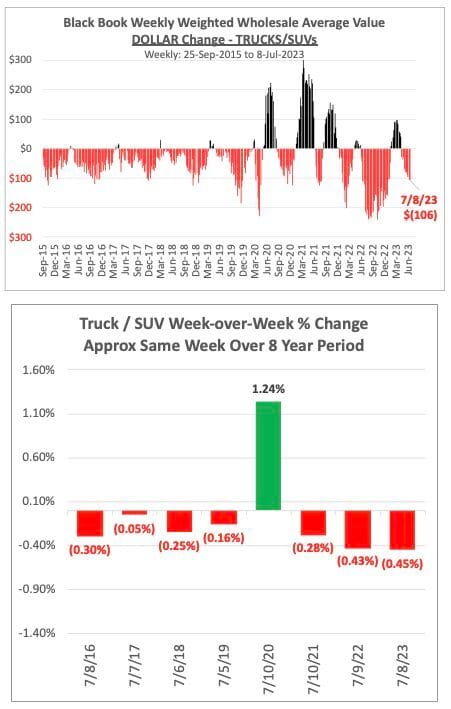

The Manheim Used Vehicle Value is 10.3% from the year ago so far in 2023. Will this trend continue? An interesting chart from auto industry consultant Bill Ploog has a hint.

The seasonal trend in pre-pandemic years predicts that every year depreciation peaks around summer time and then tapers off towards December, so looking at 2023, we will likely see further acceleration of used car price declines before the rate of declines likely slows down to a “normal” pace in Q4.

Source: Bill Ploog

Together with FullPath

Your dealership’s CRM is a goldmine - but you’re leaving $1,000,000s on the table by missing valuable opportunities.

Fullpath helps you capture more sales by creating personalized & engaging content for your inactive CRM leads.

Here’s how:

Fullpath reviews your inactive CRM leads

Fullpath automatically creates and sends personalized content based on customer interest and recent search history.

The result? Higher customer engagement and more sales.

Don’t leave dollars on the table. Click here to learn how Fullpath can help you capture more sales today.

🎙️ Transcript from CDG Podcast featuring Scott Painter, Founder & CEO of Autonomy

Subscribing vs. Owning, How Autonomy makes money, Future of mobility, Handling a large swing in value, EV predictions

Topics we discussed:

02:03 - Elon's "thought exercise" for Scott

07:47 - Scott's entrepreneurial journey

15:12 - The Softbank Saga

23:06 - Inspiration & The Innovator's Dilemma

30:25 - Building Autonomy

39:46 - The economics of a subscription-based model’

50:40 - Autonomy's ideal customer

57:22 - What does Scott drive?

Thank you for joining me again here on the CarDealershipGuy newsletter. See you soon!

Want to leave a review and tell me your thoughts about the newsletter? Reply to this email and let me know.

-CarDealershipGuy

Did you like this edition of the newsletter?Tell us what you think - we want to be the best. |

Reply