Presented by:

Hey everyone,

CDG’s Buy/Sell Tracker, covering acquisitions from the beginning of the year to today, keeps getting better.

The document is packed with the biggest dealership purchases in the U.S., with insights and interviews from the people who made them.

Bookmark it to stay up to date on the movers and shakers shaping the retail auto industry. 100% free to read.

First time reading the CDG Newsletter?

Welcome to The Breakdown, an analysis of auto retail’s top trends, moves, and insights—in under 5 minutes.

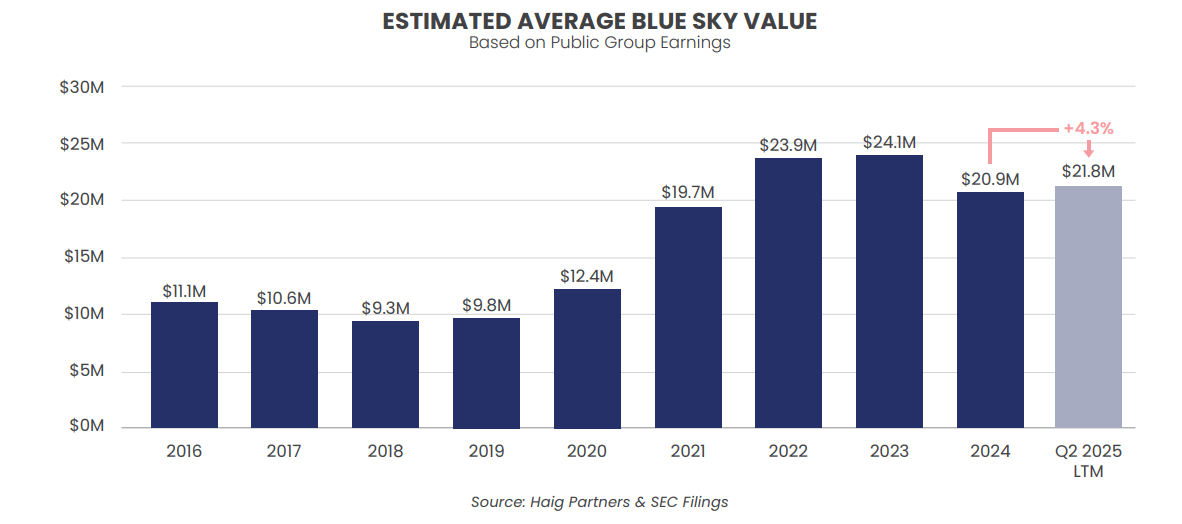

Recently, I had Alan Haig back on the Car Dealership Guy Podcast to discuss the dealership mergers and acquisitions (M&A) market. And what he told me was eye-opening.

Dealership profits are still 75% higher than pre-COVID levels. And rooftop transactions are down 39% year-over-year. Public companies are also stepping back, and there's a group of dealers who made big bets during the pandemic that are now coming back to haunt them.

Since then, I’ve spoken with a bunch of other dealers and industry professionals who shared similar signals with me. And I can’t shake the feeling that the buy/sell market is nearing a huge turning point…

Public buyers are pulling back while private groups double down on acquisitions.

Public companies acquired just 13 rooftops through the first half of 2025, compared to 22 during the same period last year—a 41% decline, according to Haig Partners.

Meanwhile, private buyers picked up 179 stores, actually increasing their activity.

The reason: Public companies are facing pressure from multiple directions, like elevated interest rates making financing more expensive, tariff uncertainty affecting future profitability projections, and shareholders questioning strategy.

That shareholder scrutiny means deals need to fit neat financial models and clear return thresholds. And when the bid-ask spread widens—as it has this year with sellers still anchored to 2022-2023 peak pricing—public companies step back rather than overpay.

But private buyers operate under completely different circumstances. They don't need to justify acquisition premiums to public shareholders.

"This year, the actual results for people who have accepted blue sky offers is more than 20% higher than the midpoint of the range we estimated," Alan said.

Alan Haig

Universal learning: Public companies are looking more closely at divestitures so they can redeploy their capital elsewhere. However, private dealers are much more flexible and tolerant of risk.

A quick word from our partner

If you're a franchise dealer, chances are we already work together.

OPENLANE powers the off-lease/grounding platforms for most major OEMs, so why not trust us with your wholesale too?

OPENLANE features:

Industry leading buyer protection with our Buyback Guarantee

Exclusive access to over 70% of all off-lease vehicles in the US

AI-enhanced condition reports

New to OPENLANE? Sign up now and receive a $2,500 buy and sell fee credit.

Tariffs are crushing Audi dealership valuations and reshaping dealers’ brand preferences.

Audi just took the biggest valuation hit Haig Partners has ever recorded. The brand's blue sky multiple dropped 1.5 turns.

Now, the multiple range for the brand is 4.0x-5.0x—falling further behind the likes of Mercedes, Lexus, and BMW.

Via Haig Partners

"Audi has zero U.S. production. So, Audi may be more impacted by tariffs than just about any brand,” Alan said.

But you see—Audi has already been losing market share. And dealers are frustrated over facility requirements that cost more per square foot than other luxury brands (while also generating lower profits).

"We had one transaction where our buyer included two really good brands, A+ brands, and an Audi store. The buyer really began to reconsider their purchase when they heard about the tariffs," Alan explained.

Meanwhile, other brands are benefiting. Toyota's multiple increased 0.25 turns. Hyundai and Kia both saw 0.5-turn increases as dealers recognized their successful powertrain strategies.

Universal learning: Production location now directly impacts franchise values, with tariff exposure creating lasting competitive disadvantages.

Some distressed dealers are selling their stores for a fraction of what they originally paid.

Over the past couple of years, many dealerships and dealer groups sold for record high prices. But as the effects of the pandemic wore off, a lot of stores went from making money… to losing it.

You can see this “normalization” in profitability below—

Via Haig Partners

"Nissan, Infiniti, Stellantis—those are brands where people have said, ‘well, I made some money during the pandemic, but I don't see a path to profitability right now, so I want to sell them,’" said Alan.

I also spoke with a prominent, highly acquisitive dealer (no, we’re not gonna put him on blast) who told me he’s currently buying a store for around $13 million less than the seller bought it for in 2022.

Whoa.

The problem: This seller was making money hand over fist during COVID with their other two stores, and thought their success would translate anywhere.

Spoiler alert—it didn't.

The store location, customer base, and brand dynamics were completely different from their other operations.

"These car dealers are crazy. They want to buy car dealerships in places they like personally, which is f***ing crazy to me," the acquisitive dealer told me. "If you like a city, buy a condo there. Don't buy a car dealership.”

Another dealer who was successful with import brands during the pandemic decided to expand and bought a struggling domestic brand store for over $15 million. After owning the store for just seven months, it had lost over $4 million, and now, the owner is selling.

And no, I don’t have hard data to back this trend up. But I do have dozens of anecdotes from dealers that tell me these aren't isolated incidents.

Universal learning: Overleveraged expansion during good times can create costly mistakes for dealers down the road.

At a high level, the days of easy dealership profits are over.

And the correction is creating a two-tier market. Premium brands in great markets are still commanding strong valuations, but distressed dealers are selling at massive discounts to motivated buyers.

However, for dealers playing the long game, the path forward is clearer than ever:

Bet on brands that hold up under tariff pressure.

Stick to markets where you know how to win.

And treat every buy/sell opportunity as a strategic move—not a trophy acquisition.

Bottom line: In a tighter, riskier environment, discipline is the new alpha.

Dealers, have you seen any signs of a buy/sell correction in your market?

Missed yesterday’s episode of Daily Dealer Live?

Presented by:

Rorhman on fixing data, Wyler on why CRMs fail, Pereira on in-house tech

Featured guests:

Ryan Rohrman, CEO of Rohrman Auto Group

Michael McDonald, Assistant Head Coach of Marketing at Jeff Wyler Automotive Family

Carolina Pereira, Marketing and Technology Director at Weston Nissan Volvo

This week on the

From dead weight to cash flow: The transfer fix for aging cars

Shout out to vAuto for making this episode possible!

Stream now on:

From the sales floor to the GM’s chair: Lauren Wilson Reeves' $1M Kia journey (and what it took)

Shout out to Cox Automotive and DLRdmv for making this episode possible!

Stream now on: