The race to build solid-state batteries is heating up—as the push to make EVs as practical and dependable as gas-powered cars becomes more pressing amid shifting marketing dynamics.

The details: Touted as the “crown jewel” of EV tech, solid-state batteries have become the centerpiece of aggressive electrification strategies—with a growing number of automakers looking to scale the idea from pilot phase to mass production.

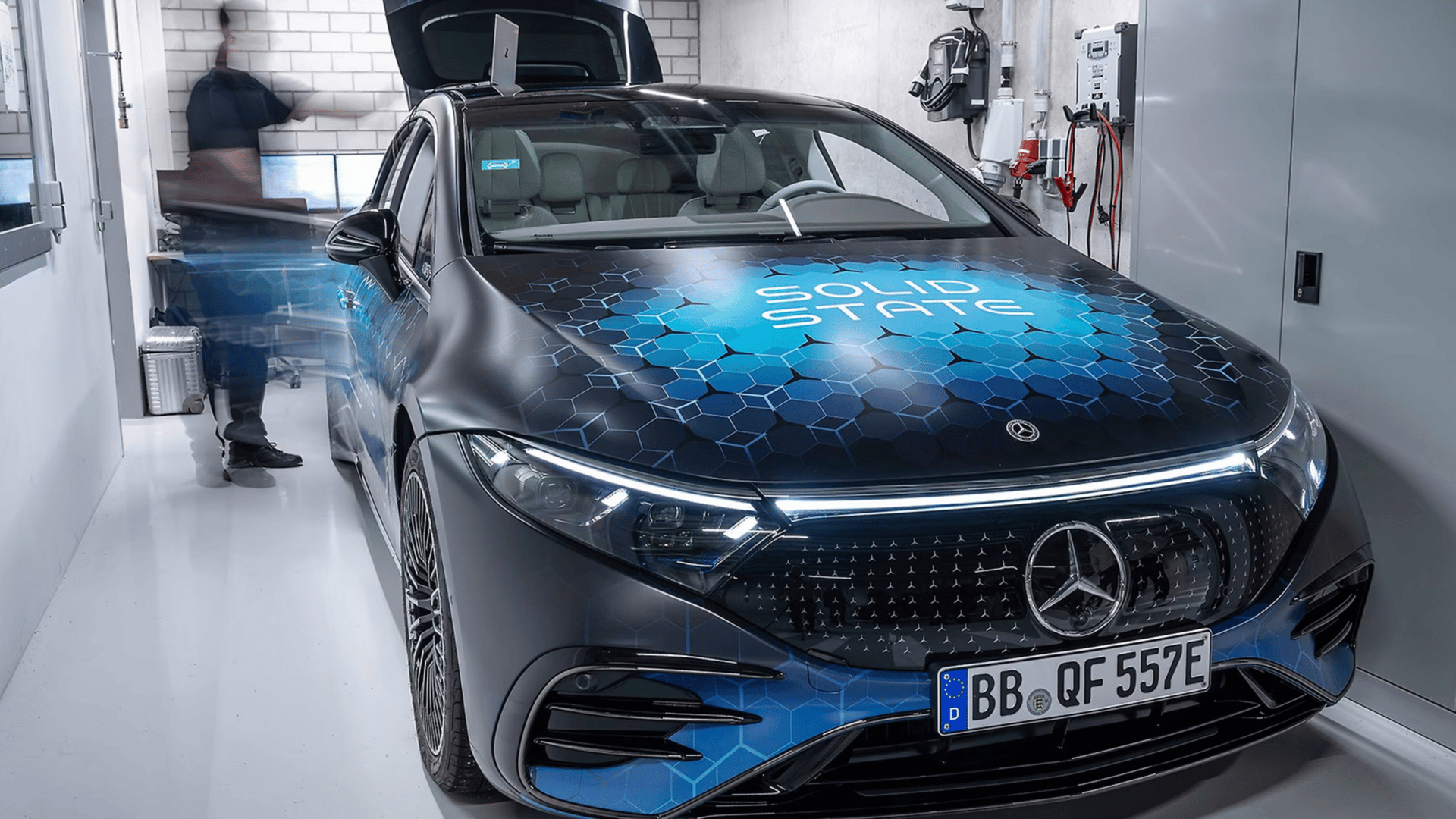

Mercedes-Benz and battery supplier, Farris Energy, announced Monday that the companies have entered an agreement to collaborate on a solid-state battery pilot production line for a solid-state battery by the end of 2025.

The Volkswagen-backed solid-state battery developer, Murata Manufacturing, and QuantumScape are exploring collaboration on large-scale production of ceramic separators for its next-gen battery cells.

Stellantis’ solid-state-battery partner, Factorial, is now using an AI digital twin platform to accelerate the testing time during battery development from months to weeks.

Why it matters: Automakers are betting billions on technology that still largely exists on the drawing board (with some exceptions), but the elimination of federal EV tax credits has created urgency around building electric cars that can compete with gas vehicles without government subsidies.

Between the lines: The potential surrounding solid-state batteries is driving more companies to invest in the technology—even amid the shifting landscape for electric vehicles like the elimination of the federal EV tax credits.

BMW and Ford are leading a $130 million funding round in the solid-state battery startup, Solid Power, which is based in Colorado.

The solid-state battery market is projected to reach $122.2 billion in 2037—with the North America market expected to account for 34% of the global revenue share.

Bottom line: Solid-state battery technology could present an investment opportunity as automakers accelerate partnerships and innovation to commercialize these next-gen batteries. However, navigating shifting EV policies in the U.S. and scaling challenges will be critical to realizing returns.

A quick word from our partner

If you’re looking to expand your dealership’s wholesale inventory, you need to hear this.

Copart helps dealers find front-line ready vehicles from finance, fleet, and rental consigners. Whether you need a late model, clean title car, truck, or SUV, they’ve got you covered with their wholesale auction every Tuesday and Thursday at 11am CST.

Every wholesale vehicle gets a 65-point inspection, detailed photos and engine audio. AI-powered insights highlight any damage while sale lights give information at a glance. And Copart’s industry-leading arbitration policy lets you file a claim within 21 days or 300 miles.

Don’t wait, your next vehicle is just one-click away. Copart’s Wholesale Auction gives you transparency that drives profitability.

Go to copart.com/wholesale for more information.

OUTSMART THE CAR MARKET IN 5 MINUTES A WEEK

No-BS insights, built for car dealers. Free, fast, and trusted by 55,000+ car dealers.