Hey, everyone. Every Tuesday and Thursday, a new episode of the Car Dealership Guy Podcast drops along with a reading companion (written by humans, not AI) that highlights the top 10 lessons from each episode.

Get the key takeaways in a quick, efficient format — delivered straight to your inbox, and never miss another episode.

Want in? Vote below, and we’ll handle the rest!

—CDG

First time reading the Car Dealership Guy Newsletter? Subscribe here.

Each week, I curate the top 5 automotive industry headlines based on the topics CDG readers engaged with the most on social media. Let’s get started.

1. Car buying dreams meet harsh market truths: survey

Americans are frustrated with car prices that don’t match their budgets, according to a new Edmunds survey.

Flashback: Many shoppers are returning to the market with outdated expectations from 2018, when inventory was high, rates were low, and incentives were common.

State of play: Today, new car prices average over $47,000, with interest rates above 7%.

Edmunds found 48% of new car shoppers want to spend under $35,000, but prices are much higher.

Used car buyers are also feeling the strain, with half hoping to spend $15,000 or less, though only 5% of transactions fall in that range.

Why it matters: As car prices and interest rates stay elevated above the norm, more consumers are being priced out or forced into less desirable choices. This mismatch is pushing car buyers to make tough decisions.

Even as inventory grows and incentives rise, core affordability issues remain a challenge, with consumers deciding to stretch budgets, settle for less, or sit out…

2. New and used car prices decline in Aug. but buyers are still hesitant

By the numbers: According to Cars Commerce, new car prices dropped 2.5% year-over-year to $48,976 in Aug., while supply rose 40.2% against 2023. Used car prices fell 4.9% from last year, though inventory only increased by 2.3%.

Despite lower prices and more availability, vehicle searches on Cars Commerce’s platform show interest down 6.6% for new cars and 3.4% for used.

The issue? Financing costs remain high, and prices have stayed relatively flat since early declines at the beginning of the year.

Zoom out: Consumers are waiting for bigger price drops. But with the recent Fed interest rate cut, 64% of surveyed shoppers may adjust their purchase timing, potentially shifting demand trends in the coming months.

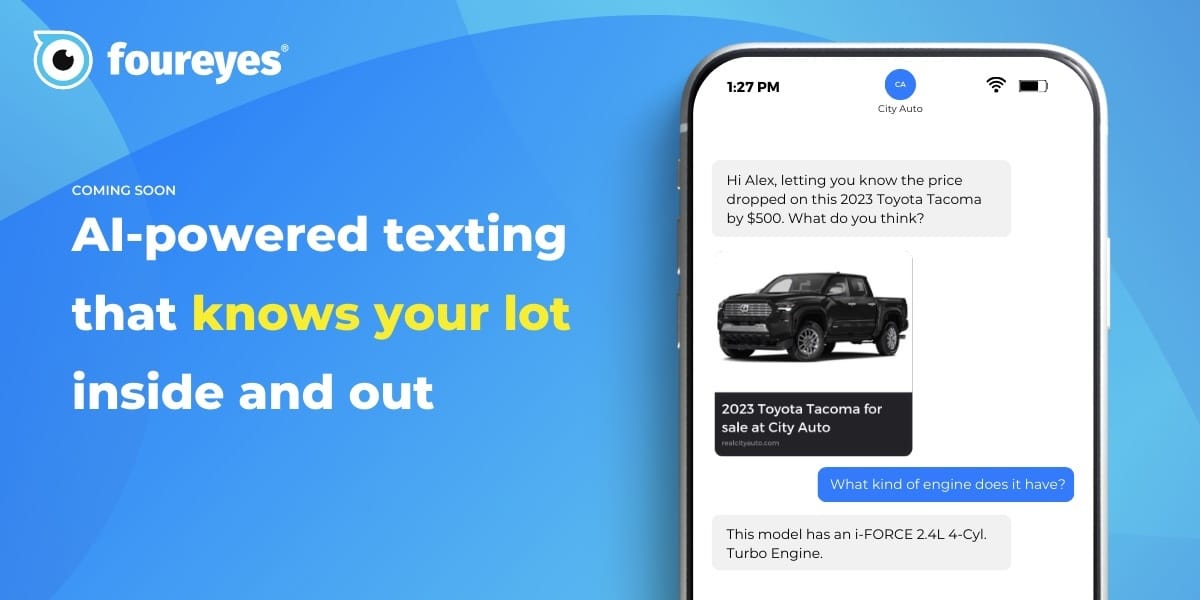

Imagine this: your prospect missed out on a vehicle they liked to someone else, but your AI assistant swoops in and texts them with the perfect alternatives.

Using your dealership’s own data.

On a day you had off.

And when you’re ready, a seamless AI handoff lets you take control of the conversation exactly as you want, with a full conversation history.

No awkward restarts, dead-ends, or repetitive messages.

Your people can do more and sell more when Foureyes helps them be more informed and empowered about relevant, in-stock inventory.

Two-way, AI-powered text alerts coming soon from Foureyes!

Despite some hesitancy from consumers, many car buyers are turning to the used car market to keep monthly payments as low as possible…

3. Aug. used car sales get a boost

Dealers sold more used cars month-over-month in Aug., helped out by falling prices.

Quick facts: In Aug., used car sales hit 1.7 million units, marking the highest level in three years.

Dealers saw an 8% increase in sales from July and a 13.6% jump compared to last year.

On top of that, interest rates on used cars fell slightly to 11.3%, helping buyers out a little bit more.

Despite the higher demand, inventory levels grew, reaching 44 days' supply.

More vehicles priced under $15,000 also entered the market. Now, dealers are faced with the challenge of balancing lower prices with shrinking profit margins as the market ebbs and flows.

Affordability has proven to be a tough nut to crack. In addition to the used car market, leasing (especially EVs) is another avenue more shoppers are exploring to keep monthly payments low.

4. EVs are doing their part to help leasing recovery

Leasing market penetration hit 25.35% in Q2 2024, up over 4% from last year, according to Experian.

What’s happening: As new car loans become harder to get, budget-conscious buyers are turning to low APR lease deals offered by automakers’ finance arms. It’s a smart move, especially as more new models roll out and leasing becomes an easier way to get behind the wheel.

The catch? You’ll need a solid credit score to qualify for the best rates, but that’s where EVs come in.

Almost 50% of new EVs are leased now, thanks to generous tax credits that lower payments without all the restrictions.

Compact EV leasing, in particular, is booming—up 90% compared to traditional compact cars.

Bottom line: Leasing is bouncing back, and it’s quickly becoming the go-to option for buyers looking to save.

Have a tip for our editorial team? Send us your scoop at [email protected].

While leasing hasn’t quite returned to pre-pandemic levels, it’s getting closer, and with 2025 models arriving soon, expect even more incentives to keep driving the trend forward…

5. Certain brands can’t hold off on incentives any longer

New vehicle inventory has finally stabilized after the disruptions caused by June’s cyberattack, bringing things back to where they were earlier this summer.

By the start of September, there were 2.84 million unsold units on dealer lots, barely any change from June, showing supply levels have smoothed out.

Days' supply is holding at 77—still higher than last year but in line with what we've seen over the last few months.

The big news? New model-year vehicles are hitting showrooms, now making up around a quarter of inventory.

Yet – brands like Nissan, Ford, and Stellantis are still dealing with an oversupply of older models, even with incentives creeping up to 7.2% of the average transaction price.

Bottom line: While inventory has stabilized, some automakers have more stock than they’d like. Expect more incentives to clear out older models and make room for the new ones hitting the lots.

We’ve got tons of great jobs hitting the CDG Job Board right now:

Gregg Young Automotive Group needs a GM-certified technician in Iowa.

Ron Marhofer Auto Family is looking for an F&I manager in Ohio.

Foureyes is looking for a fully (remote) account executive.

Looking to hire? Add your roles today—it’s 100% free.

That’s a wrap for now – make sure you’re following along on X, LinkedIn and IG for more real-time updates.

🚨 Hey you! Before you go…

Did you like this edition of the newsletter?

Thanks for reading. Hit reply and let me know if you found this week-in-review valuable or have any feedback. I’ll see you next weekend.

—CDG

Want to advertise with CDG? Click here.

Want to be considered as a guest on the CDG podcast? Right this way.

Want to pitch a story for the newsletter? Share it here.